STM3100E

Product DetailsIntroductionThe New-type Interactive Terminal is a cutting-edge product independently developed byGEIT in recent years, specifically tailored for the banking sector. Integrating the business capabilities of banks traditional counter ser…

Product Details

Product Details

The New-type Interactive Terminal is a cutting-edge product independently developed byGEIT in recent years, specifically tailored for the banking sector. Integrating the business capabilities of banks' traditional counter services, self-service terminals, and super counter services, this product has evolved into a compact, portable, and highly expandable desktop device. It breaks the fragmented usage pattern of banks' siloed business types and dedicated devices, forming an integrated "triple-counter convergence" solution. This innovative design empowers banks to move towards integrated development, digital and intelligent empowerment, and comprehensive service delivery.

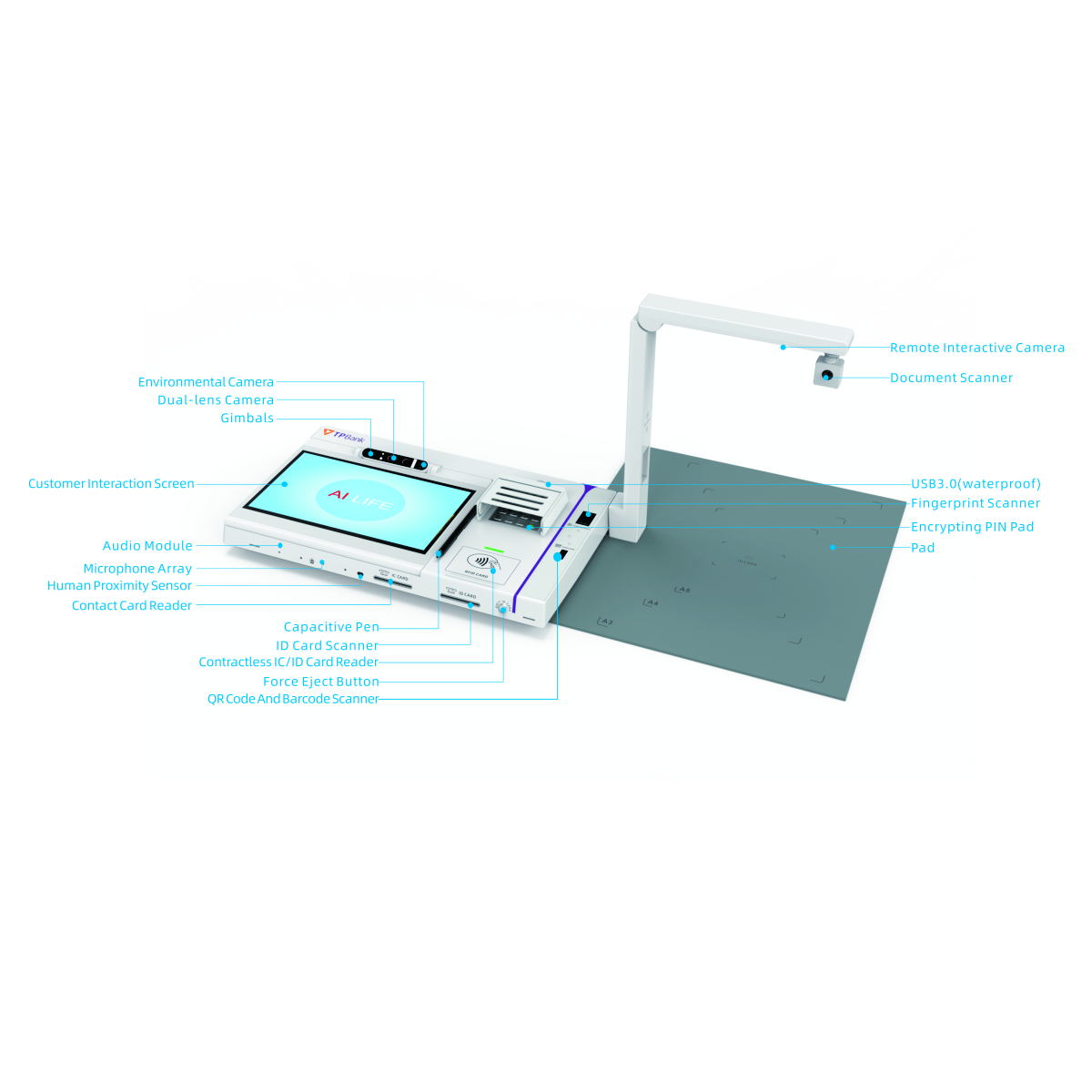

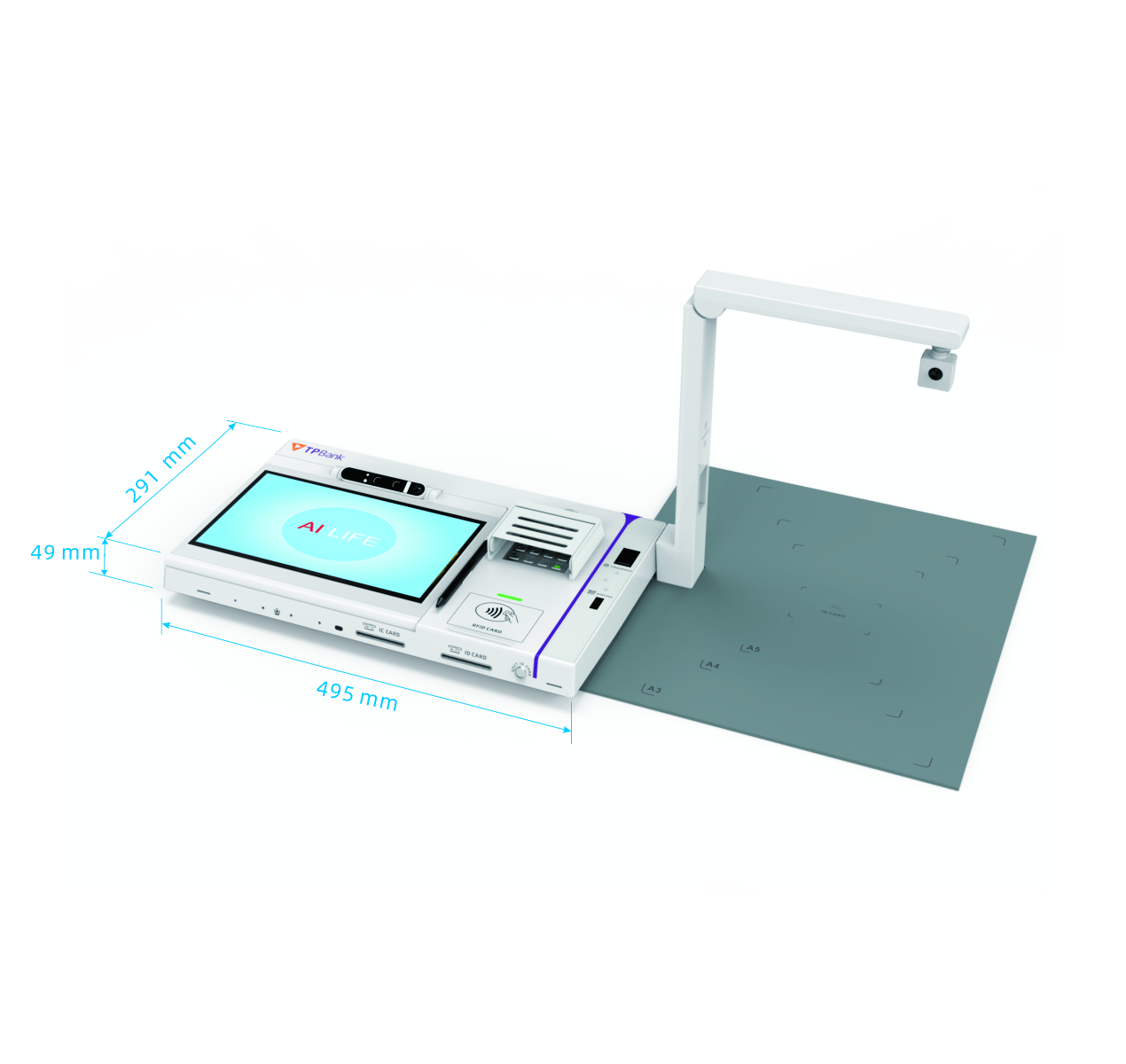

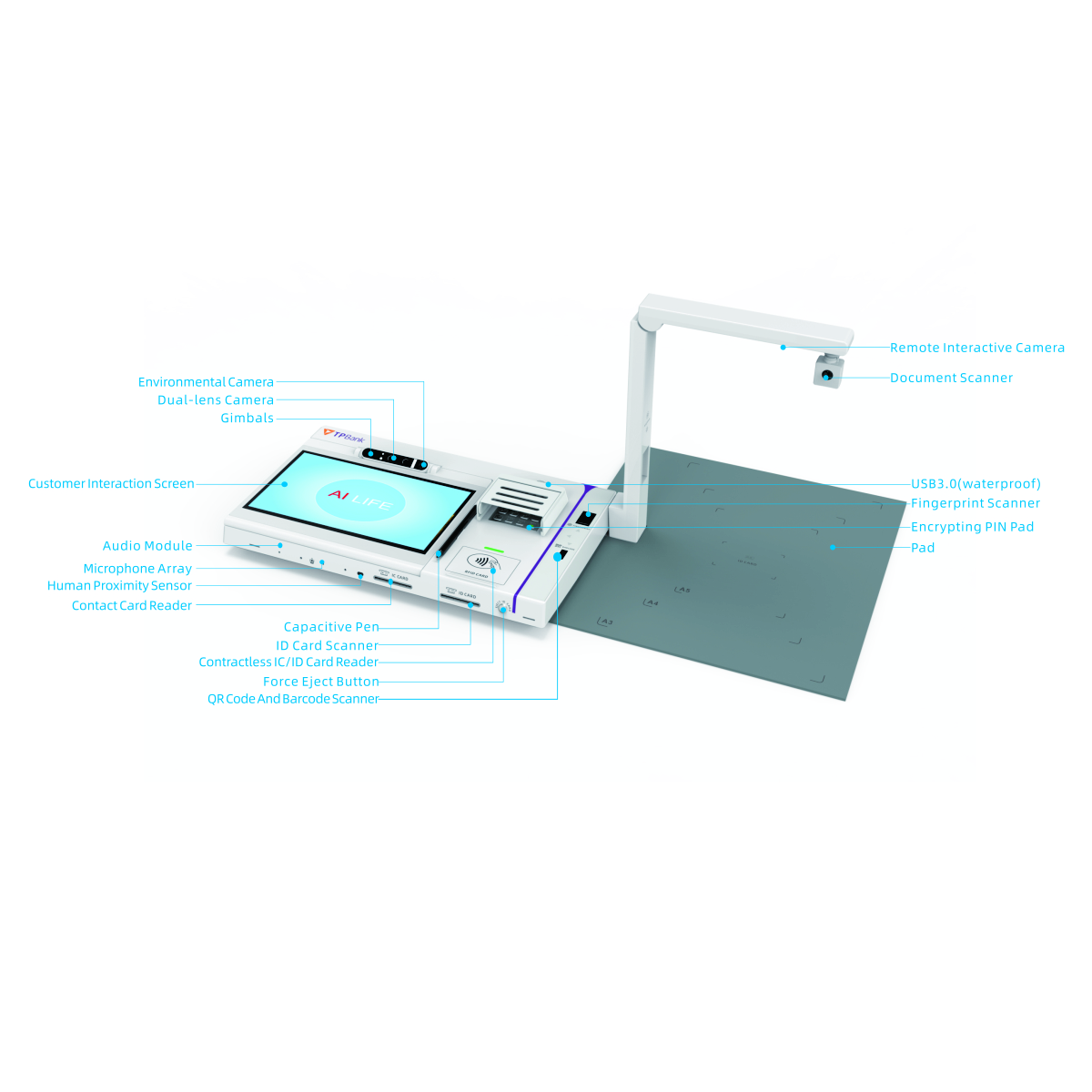

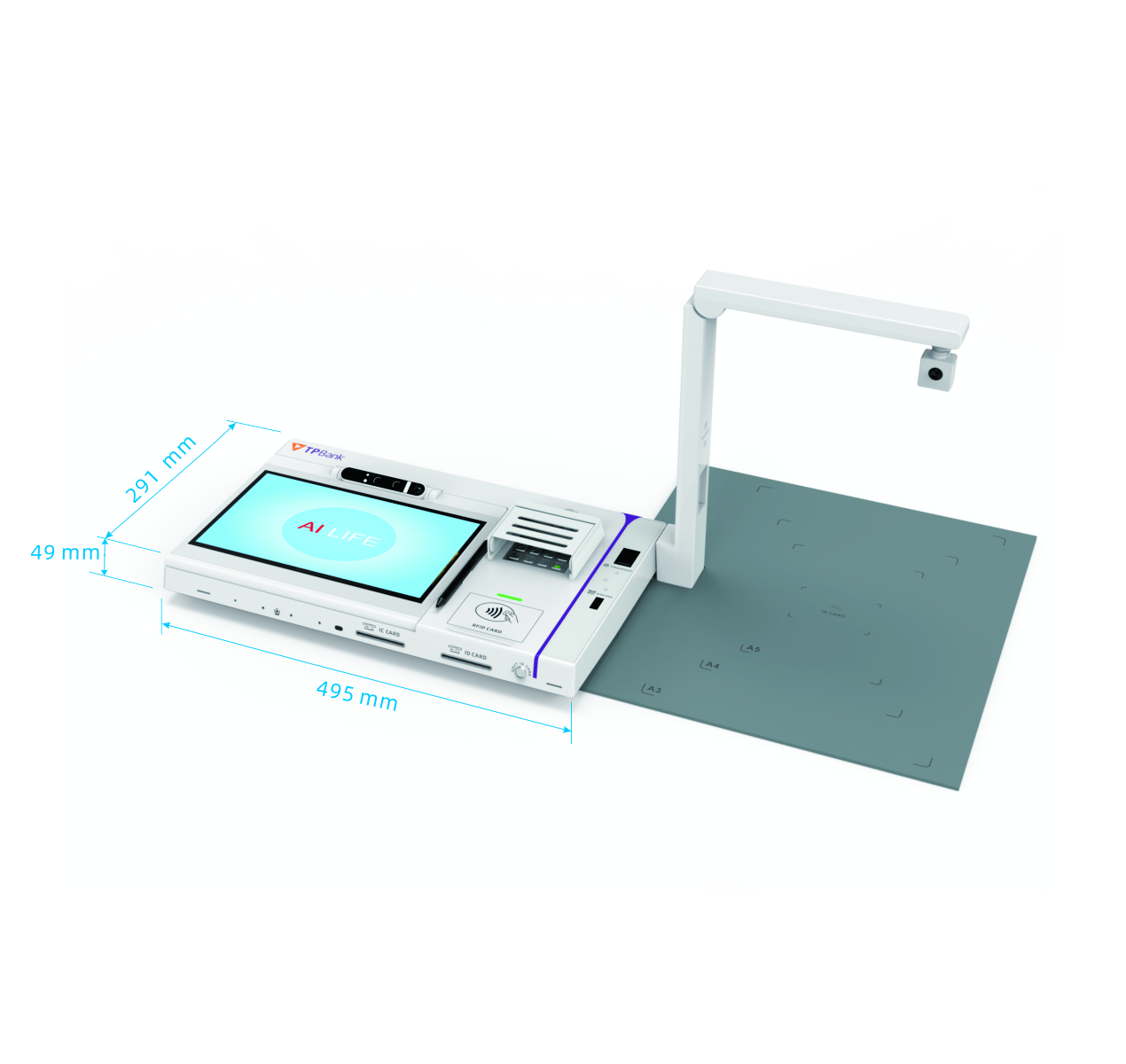

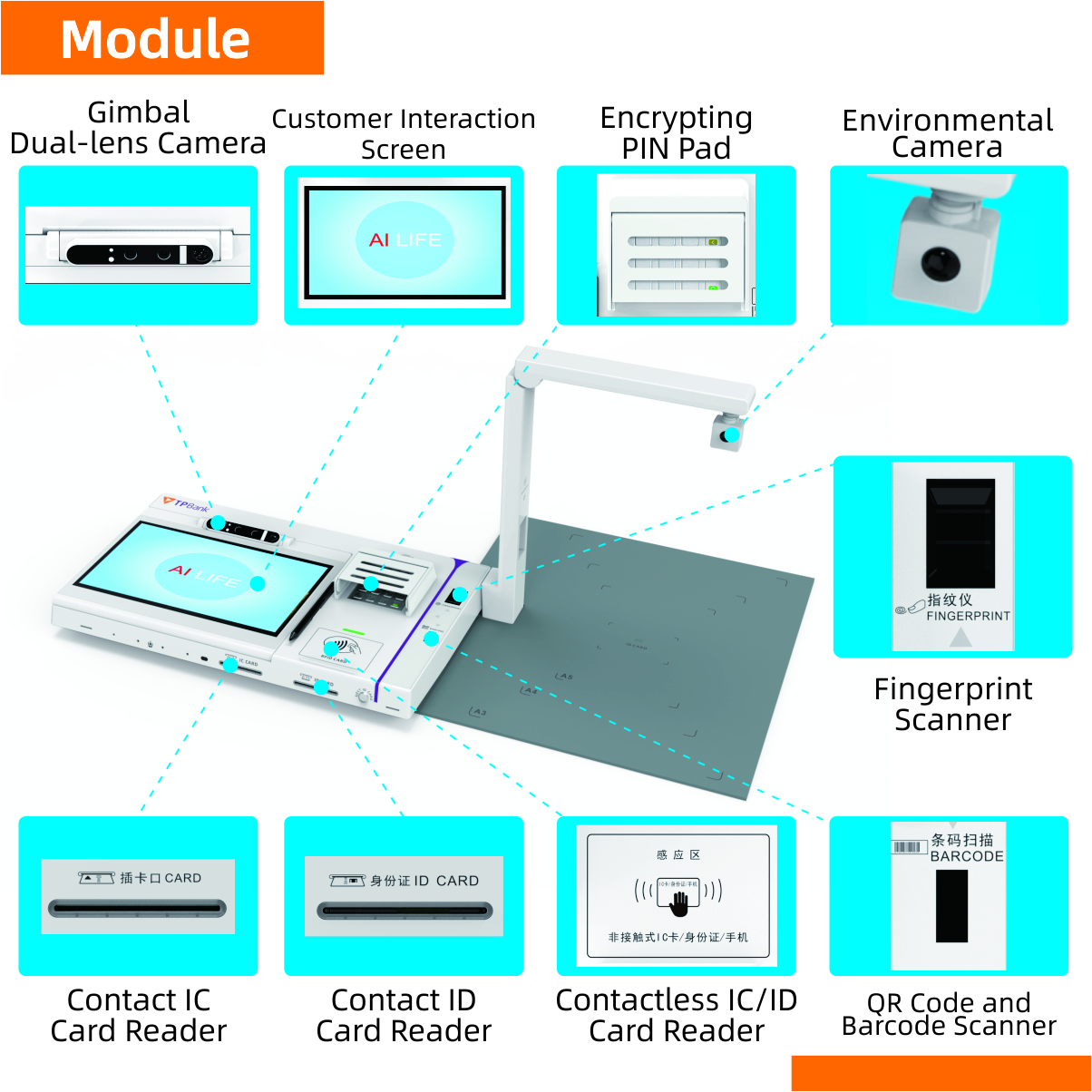

The terminal comprises the following core components: contactless/contact card reader, inhalation-type ID card reader, magnetic stripe read/write module, fingerprint scanner, PIN pad, electronic signature pad, binocular PTZ tracking camera, document camera, barcode scanning module, and array microphone. It can also connect to specialized peripheral modules such as printers, scanners, card dispensers, and security token dispensers via a docking station. Additionally, optional modules including an expansion screen, telephone handset, wireless communication module, and portable trolley case are available to further enhance interactive capabilities and expand application scenarios.

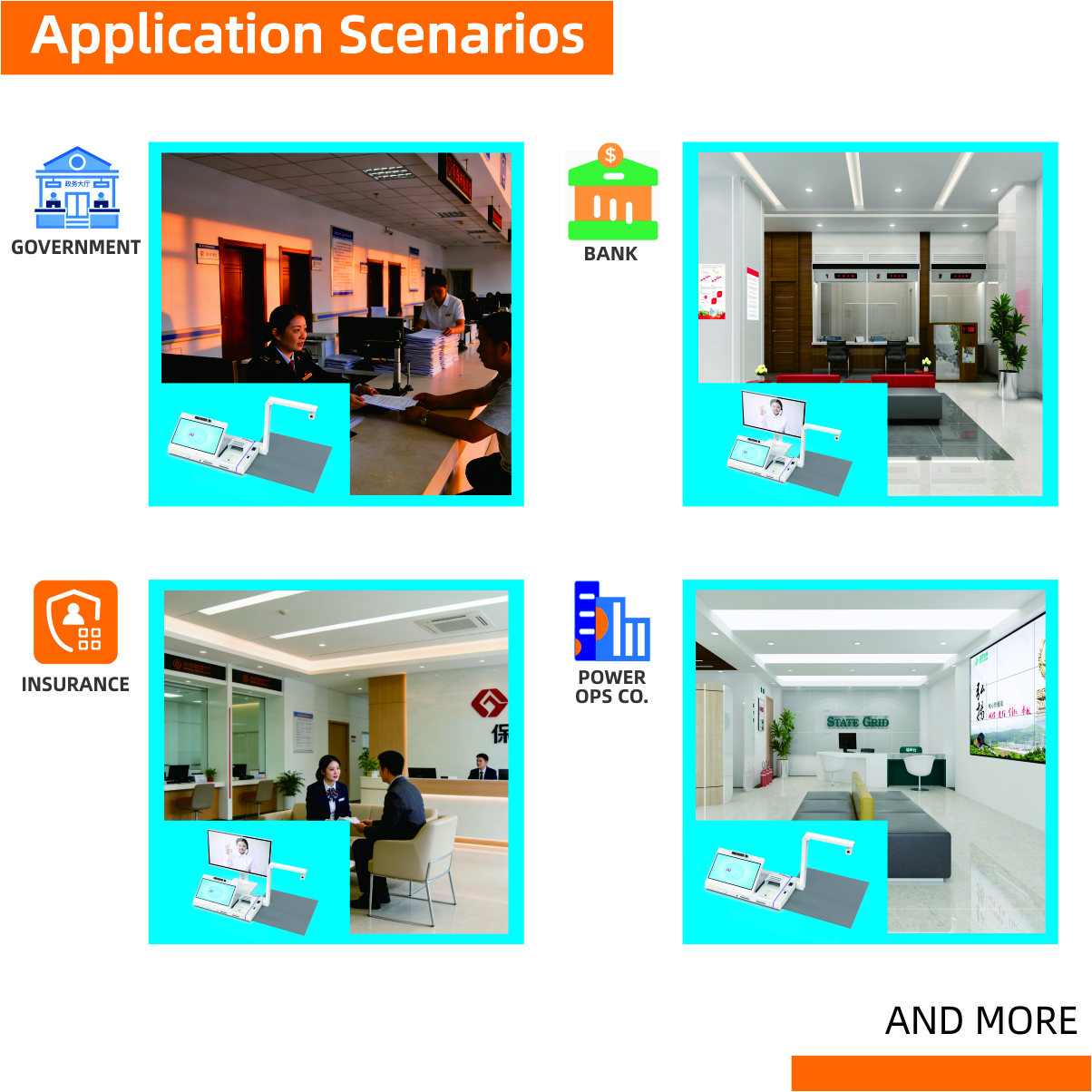

Counter Mode: Deployed in any counter scenario within bank branches, enabling face-to-face or adjacent seating between customers and tellers. A single device integrates a built-in transaction module and supports connection to all expansion modules, realizing the functions previously achieved by multiple discrete peripheral devices. It supports the opening and maintenance of personal and corporate accounts, the signing and modification of various services, as well as the handling of various businesses including fund transfers and wealth management.

Remote Mode:

Deployed in personal banking service scenarios within branches, this mode enables remote tellers located at branch-level back-end service centers to guide customers through business processing via an audio-visual system. Compared with the Counter Mode, the range of supported services remains unchanged.For banks, this mode allows centralizing teller resources scattered across various branches, improving personnel utilization and professional skills while facilitating branches to extend their reach to towns, townships, and communities. For customers, it provides access to more professional and experienced teller guidance.

Self-Service Mode:

Deployed in personal banking service scenarios within branches, this mode enables customers to handle business independently. In areas where branch business is heavy, it helps alleviate the workload of lobby managers.

External Expansion Mode:

The terminal and peripherals are packaged in a trolley case, allowing business personnel to carry the equipment for on-site visits to customer premises. Standard counter business processing functions are enabled via dedicated network channels. Leveraging the device’s portability, this mode empowers banks to proactively step out of branches, serve customers on-site, and conduct proactive marketing. It helps banks bridge the gap with enterprises while reducing the burden on enterprises of visiting branches in person.

This mode breaks the traditional service model where banks passively market from their branches. While serving customers, it enables banks to understand customers' development status, strengthen customer relationships, and provide a channel for more targeted marketing activities in the future.

Previous: Queue Machine

Next: None

Related products

Feedback On Opinions

Take a screenshot and recognize the QR code

Guoguang Information