Release date: 2019-06-28 16:08:49 | View: 34

Summary:

Recently, our company received the Bid-winning Notification for the Self-service Bill and Cash All-in-one Machine Project issued by Bank of Communications Co., Ltd. (hereinafter referred to as "Bank of Communications"), successfully securing…

Recently, our company received the Bid-winning Notification for the Self-service Bill and Cash All-in-one Machine Project issued by Bank of Communications Co., Ltd. (hereinafter referred to as "Bank of Communications"), successfully securing the bid for this project.

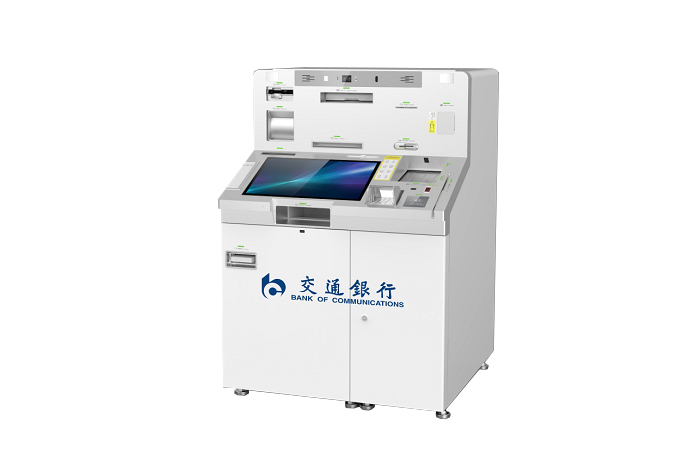

Three product models were selected for Bank of Communications' Self-service Bill and Cash All-in-one Machine Project, namely the Self-service Bill and Cash All-in-one Machine, High-value Cash Acceptance Auxiliary Cabinet, and Bill Acceptance Auxiliary Cabinet. Each product boasts distinct functional focuses. They can be flexibly combined with the existing intelligent equipment at bank outlets, tailored to the positioning of individual branches. This integration drives the transformation of in-branch service models, enhances service efficiency, and elevates the overall user experience.

Backed by years of R&D experience and robust technical capabilities in both cash and non-cash self-service equipment, GEIT has developed a full range of self-service bill and cash handling products in alignment with Bank of Communications' strategic goal of transforming in-branch service models and in strict accordance with the bank's specific requirements. The overall configuration of the equipment has undergone comprehensive optimization and upgrading on the basis of meeting Bank of Communications' needs, resulting in overall performance that exceeds the bank's specified standards. Special design considerations have been incorporated to ensure the equipment excels in terms of advanced technology, security, user-friendliness, maintainability, reliability, innovation, and compatibility.

Founded in 1908, Bank of Communications is one of China's oldest banks and also one of the note-issuing banks in modern Chinese history. On April 1, 1987, the restructured Bank of Communications officially commenced operations, becoming China's first nationwide state-owned joint-stock commercial bank with its headquarters located in Shanghai. In June 2005, Bank of Communications was listed on the Hong Kong Stock Exchange, followed by a listing on the Shanghai Stock Exchange in May 2007.

Bank of Communications adheres to the development strategy of "Pursuing Internationalization and Integration to Build the Best Wealth Management Bank" (abbreviated as the "Two-in-One" Strategy). The Group's business scope encompasses commercial banking, securities, trust, financial leasing, fund management, insurance, and offshore financial services. By the end of 2018, Bank of Communications had 238 domestic branches, including 30 provincial branches, 7 directly affiliated branches, and 201 municipal branches. It operated a total of 3,241 business outlets across 239 prefecture-level and above cities, as well as 163 counties and county-level cities in China. Its non-bank subsidiaries mainly include wholly-owned subsidiaries such as BOCOM Financial Leasing Co., Ltd., China BOCOM Insurance Co., Ltd., and BOCOM Financial Assets Investment Co., Ltd., as well as controlled subsidiaries including BOCOM Schroder Fund Management Co., Ltd., BOCOM International Trust Co., Ltd., BOCOM Concord Life Insurance Co., Ltd., and BOCOM International Holdings Co., Ltd. In addition, Bank of Communications is the largest shareholder of Jiangsu Changshu Rural Commercial Bank Co., Ltd., a co-largest shareholder of Tibet Bank Co., Ltd., a strategic investor in Hainan Bank Co., Ltd., and controls 4 village and township banks.

The year 2018 marked the 110th anniversary of Bank of Communications' founding. Standing at this new milestone, Bank of Communications has endowed the "Two-in-One" Strategy with new connotations and launched the "186" Strategic Blueprint. The "1" represents the strategic goal of prioritizing "Building the Best Wealth Management Bank", with the core tenets of creating shared value and delivering top-tier services. The "8" denotes eight strategic initiatives to strengthen and optimize the bank's operations and enhance customer service capabilities, covering customer-centricity, the "Two-in-One" (Internationalization and Integration) approach, "Dual-engine" (Business Unit + Branch) drive, "Dual-channel" (Online + Offline) collaboration, technology empowerment, talent development, risk management, and corporate culture building. The "6" refers to the "Three Growths and Three Reductions" business strategy, namely increasing effective customers, core liabilities, and transformation-driven revenue, while reducing risk costs, capital occupancy, and operating costs.

As a large state-owned banking group with a long-standing history, clear strategic vision, standardized corporate governance, stable operations, and high-quality services, Bank of Communications has always been committed to implementing national strategies and serving the real economy. It continuously strengthens comprehensive risk management, advances deepening reforms, strives to provide the best services for customers, create greater value for shareholders, build a fulfilling workplace for employees, and make more significant contributions to society.

As a total solution provider with premium products and strong brand influence in the financial self-service equipment sector, GEIT has earned high praise from banking institutions for the practical application of its product portfolio and solutions. Its professional, timely, comprehensive, and thoughtful services have also gained the trust of customers. This reflects GEIT's unremitting efforts to uphold its service tenet of "Leading Financial Self-service Through Technological Innovation" across its entire spectrum of products, solutions, and comprehensive services. Going forward, GEIT will continue to improve product quality, elevate service standards, ensure the safe and stable operation of its equipment, and contribute its share to the construction of intelligent bank outlets.

Related News

On August 25, 2025, Professor Arieh Warshel, winner of the 2013 Nobel Prize in Chemistry and founder of computational che…

With the rapid development of financial technology, customers requirements for banking services are increasingly rising. …

GEIT has collaborated with Evergrowing Bank to develop the "Mobile Luggage" project. This project truly fulfi…

Take a screenshot and recognize the QR code

Guoguang Information